- When he assumed his post as professor of economics at Chittagong University in 1972 MUHAMMAD YUNUS established a Rural Economics Program to do research in the villages.

- YUNUS’ solution is the Grameen (village) Bank Project (GBP) for the landless.

- All loans are made to members of a group of five men or women, two of whom are given loans, with the other three eligible only when the first two start making their weekly repayments.

- The RMAF board of trustees recognizes his enabling the neediest rural men and women to make themselves productive with sound group-managed credit.

Throughout the “third world” inadequate access to reasonable credit in most villages remains a major hurdle to the fulfillment of basic human aspirations. Complex application procedures and lack of connections and collateral are insurmountable impediments. Ironically moneylending, especially to the poor, makes many fortunes and scarce resources are immobilized for consumption rather than invested in development.

Usury rates throughout much of Asia and some other lands illuminate the problem. Bangladesh villagers routinely pay 120 percent annual interest on loans used for investment and consumption purposes. Metro Manila market vendors commonly operate on a “five-six system,” paying 20 percent interest per week on their borrowed capital. Especially in agriculture such exorbitant rates cripple investment. Access to credit at more reasonable rates often favors those who already hold wealth or exercise power, thus stifling more egalitarian participation in the economy.

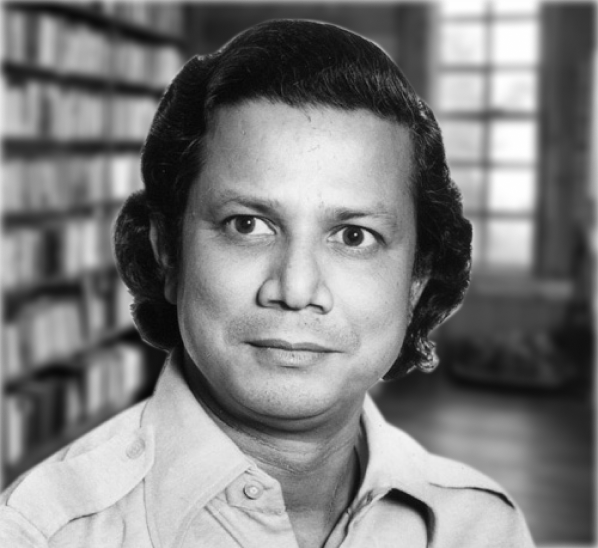

When he assumed his post as professor of economics at Chittagong University in 1972 MUHAMMAD YUNUS established a Rural Economics Program to do research in the villages. Beginning with an idle tubewell, abandoned for lack of management, he developed in 1974 the Tebhaga Khamar (three-share farm) program which the government has adopted as the Packaged Input Program. To make it effective YUNUS and his associates found it essential to propose a new institution — Gram Sarkar, or village government — which would allow ordinary people to participate in making the decisions affecting them. Gram Sarkar was adopted by the government as a national model in 1980, but dropped by the succeeding regime.

However, even these efforts proved inadequate to arrest a process of pauperization that left ever more villagers without hope. And the traditional poverty-focused programs proved incapable of “breaking out” of the straightjacket of ingrained habits and half-truths compounded by myths. Supposedly, the poor cannot save, will not work together, have no marketable skills, are uninterested in change and the women are not allowed to keep what they earn. Thus the life of the poor is a vicious self-perpetuating quandary, and population growth multiplies their burdens.

YUNUS’ solution is the Grameen (village) Bank Project (GBP) for the landless. It aims to: 1) extend banking facilities to the poorest segment of society, 2) bypass moneylenders, 3) create self-employment for unutilized man/woman power, and 4) bring the disadvantaged into an organization they can understand and operate. It began in 1976 at Jobra near Chittagong University where the Bangladesh Krishi Bank in 1978 agreed to establish a branch with operational policies designed by YUNUS and his Rural Economics Program.

All loans are made to members of a group of five men or women, two of whom are given loans, with the other three eligible only when the first two start making their weekly repayments. Groups meet weekly and monitor each member’s performance. Repayment of loans on schedule has been better than 98 percent. Group members also must save weekly for capital in their Group Fund.

For over 100,000 villagers, formerly submerged in poverty, but who today have utilized GBP loans, the results of releasing productivity have been spectacular. They have built small mustard seed oil mills, bought cows and goats for fattening, begun weaving saris and making fish nets, started pottery works and betel nut growing, purchased fertilizer for rice growing, and expanded the inventory of their small shops. The evidence is compelling that even the poorest villagers have sound ideas about how to use effectively loans ranging from the equivalent of US$2 to US$2,100.

Only 44 years old, YUNUS, his ex-students from Chittagong University, and their collaborators in the Bangladesh banking fraternity — with a modest investment of less than US$8 million — have launched a major, positive rural change in one of the world’s poorest nations. Their collaboration has brought closer the day when it again can become “Golden Bangla.”

In electing MUHAMMAD YUNUS to receive the 1984 Ramon Magsaysay Award for Community Leadership, the Board of Trustees recognizes his enabling the neediest rural men and women to make themselves productive with sound group-managed credit.

I am deeply touched by the great honor given to me by electing me a Ramon Magsaysay Awardee. It was a big surprise to hear the news about the Award. I still cannot make out how the trustees of this prestigious foundation could notice a small effort such as ours, which has reached only some 100,000 in a population of more than 90 million. I can only admire the foundation for taking a big risk in choosing me, and in demonstrating its confidence in our work when we need it the most.

As a student of social science I could not feel comfortable with what I learned. When it came to applying this knowledge in solving real problems, it appeared toothless. I continued to get a feeling that the knowledge that we present in the discipline of social science is replete with pretensions and make-believe stories. We have picked up the habit of imagining things, rather than seeing things as they are.

Social scientists enjoy being up above in the sky and having a panoramic bird’s eye view over a wide horizon. A bird’s eye view is certainly very revealing when you’ve already fortified yourself with enormous quantities of close-up shots at ground level and you know what you are looking at. The view from the sky without the supportive close-up view from the ground merely encourages you to take recourse to daydreaming.

Not all people have access to a bird’s eye view. Poor people don’t. They are too busy eking out a survival for themselves with their worm’s eye view. With this view they have to assess their immediate neighborhood in a continuous search for a way which will keep them out of trouble today.

When a problem is seen in a lumped form, it is easy for the viewer to be overwhelmed by its enormity. In many cases, however, large problems are merely a composite of a great number of simple problems. Simple problems can be solved by simple people. But by putting them together to make a complex problem we take them out of the comprehension of the everyday person. Once we remove something from the comprehension of an individual, we have incapacitated him mentally and physically. He cannot make himself useful in any way in solving the problem.

Poverty can be better understood if we look at it from the ground level and at a very close range. Then, instead of generating billions of words about it, we can find ways to cope with it.

Poverty is not caused by a person’s unwillingness to work hard or lack of skill. As a matter of fact, a poor person may work very hard — even harder than others — and he has more skill and time than he can use. He languishes in poverty because he does not receive the full worth of his work. Under the existing social and economic institutional arrangements someone else always comes in between and skims off the income that was due to him. The existing economic machinery is designed in such a way that it allows this process of grabbing to continue and gather strength everyday, so that the earnings of others can make a handful of people richer and turn a large number of people into paupers.

A poor person cannot arrange a larger share or return for his work because his economic base is paper thin. If he can gradually build up an asset-base he can command a better share.

Land to the landless will help build up this base. There are other forms of assets which will improve his economic situation. Credit, for example; it is a liquid asset. The recipient of credit can decide which particular tangible form he will convert this asset into. Best of all, credit is something that a nation can generate at a rate commensurate with its requirements.

With financial resources at his disposal, an individual is free to build his own fate with his own labor. Nothing can match the spirit of a free human being.

Many suggest generation of employment as the solution to the problem of poverty. Employment per se does nor remove poverty. Unless designed properly, employment can turn into a handle to perpetuate poverty. Employment may mean being condemned to live in a squalid city slum or working for two meals a day for life.

Removal of poverty must be a continuous process of creation of assets by the poor at a steady rate. Poor people know what they must do to get out of the rut. But the people who make decisions refuse to put faith in their ability.

In Grameen Bank, not only are poor men and women changing their lives by their own efforts, in the process they are changing the lives of the people who work with them. Bank workers, who are in fact the architects of this bank, continuously surprise us with their ability and willingness to put in extra hours, travel longer distances in difficult terrain, and reach toward new horizons of activities. On this magnificent occasion I wish to record my sincere thanks and gratitude to them for making Grameen Bank a great institution.

I am overwhelmed by the honor you have granted me. I realize very well that I am receiving this Award because hundreds of young men and women in the Grameen Bank have been working so hard to make a dream come true. With all humility in my heart I receive this wonderful Award and thank you, and then my co-workers.